By Zamira Rahim, CNN Business

Updated 0813 GMT (1613 HKT) May 13, 2020

London (CNN Business)ー Will Murrell had hoped to pass his further education examsthis summer, at a college in London.He was hunting for a job, in a retail outlet or supermarket, to earn some extra money alongside his studies.

Then Covid-19 struck. Now the 17-year-old is stuck at home with his parents. His exams have been canceled and all his plans are on hold.

“I’ve been looking for jobs and now we’re in lockdown, so I can’t,” Murrell told CNN. “It seems like an unnecessary risk.

“Murrell is part of Generation Z, those born after 1997, as defined by the Pew Research Center. The group’s eldest members are now graduating into a labor market that’s been devastated by the global pandemic.

As a disease, coronavirus disproportionately preys on the elderly. But Generation Z, at least in the short term, is set to bear the brunt of the ensuing financial chaos.

MORE ON COVID-19’S IMPACT

The UK economy is heading for its worst crash in 300 years

How 39 million Europeans kept their jobs after the work dried up

UK overtakes Italy to record highest coronavirus death toll anywhere in Europe

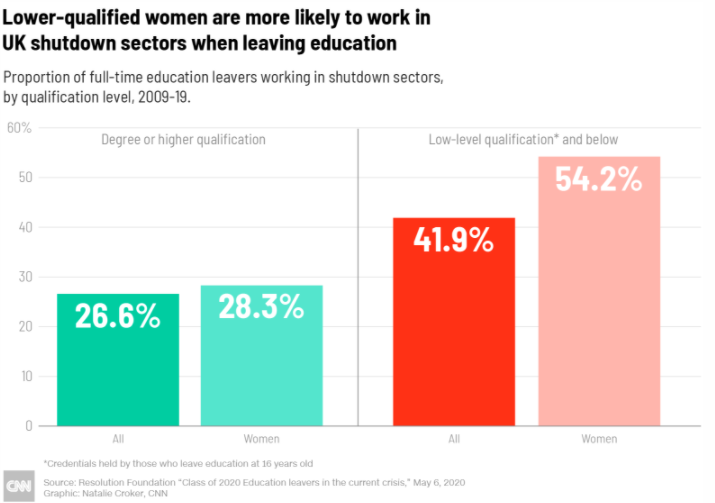

Workers of this cohort are more likely than older generations to work in industries shut down by social distancing restrictions, according to the Pew Research Center and the Resolution Foundation.

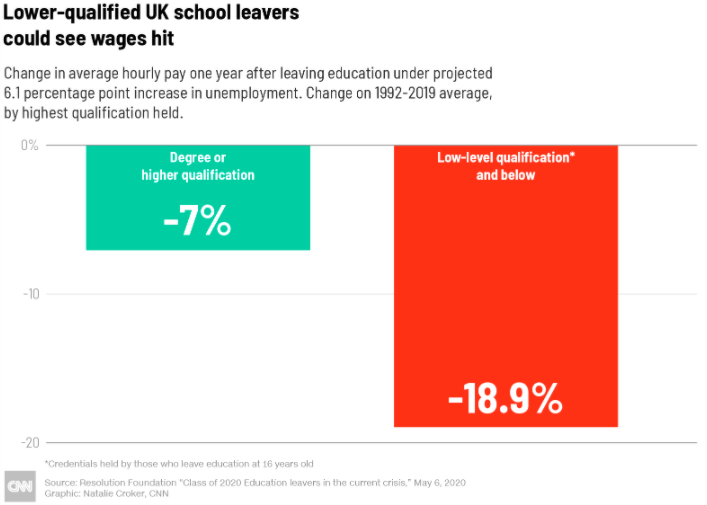

Generation Z’s future prospects also look gloomy; the Resolution Foundation’s analysis suggests that layoffs linked to the pandemic could affect young people’s pay and job prospects in the long-term.

The world is still in the early stages of the most severe economic crisis since the 1930s, with lockdown measures, social distancing and lost production triggering a global recession. In the United Kingdom, the economy could shrink by 14% this year and unemployment is expected to hit 9%.

The impact of unemployment in a recession is particularly severe on those who have just left school. Fewer jobs and internships are available to younger people searching for work, especially in sectors such as hospitality, travel and retail, which provide large numbers of entry level roles and have been slammed especially hard by the effects of the pandemic and efforts to contain it.

In the UK, the unemployment rate for 18-24 year-olds is projected to hit a staggering 27% this year, up from 10.5% in 2019, according to analysis from the Resolution Foundation.

This means an extra 640,000 people in the age group are likely to be out of work.

“The unique nature of the current crisis has damaged the first rung on the employment ladder for a substantial proportion of education leavers — and it is so far unclear when, and to what extent, these sectors will recover,” the report notes.

Young bear brunt of crisis

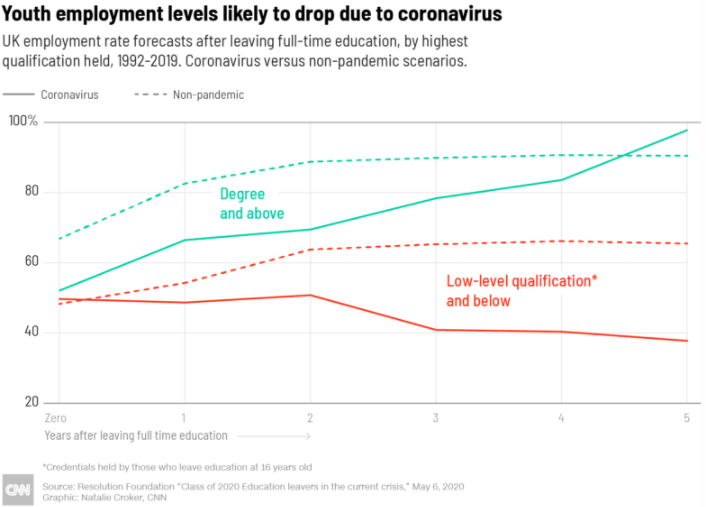

The crisis could leave lasting scars. Thanks to the spike in UK unemployment, today’s graduates are 13% less likely to be employed in three years’ time compared to a scenario without the pandemic.

Those with mid-level qualifications are 27% less likely to be employed in three years, while the figure rises to 37% for “lower-skilled” adults leaving education today, according to the report’s projections.

It’s a similar story in the United States, where workers under 24 were disproportionately affected by initial layoffs related to coronavirus, according to Richard Fry, senior researcher at the Pew Center.

The shutdown triggered a surge in unemployment in the US, with the county’s economy losing 20.5 million jobs in April, the largest decline since the government began tracking the data in 1939.

According to the Bureau of Labor Statistics, unemployment rates in April rose sharply among all major worker groups. The unemployment rate for teenagers aged 16-19 was the highest of all the groups, at 31.9%.

The unemployment rate for adult men in April was 13%, while the same figure for adult women was 15.5%.

“Initially, at least, layoffs were concentrated in a certain set of industries, which hit the 16-24 age group hard,” Fry told CNN. “That initial unemployment was very much concentrated on … Gen Z. [They] got hit badly.”

Those currently most at risk of layoffs work in retail, in restaurants, hotels and child care -— sectors most affected by social-distancing restrictions. Overall, younger workers make up 24% of those employed in industries at high risk of being shut down in the pandemic, according to the Pew Research Center.

Despite the early data, Fry said Generation Z has some reason to be optimistic. He said the younger group has time to recover from the virus’ impact, especially when compared to the Millennial generation.

“When it comes to wealth-building, one is … able to better deal with a crisis if you …have more years to adjust,” Fry said.

While Fry is cautiously optimistic about Generation Z’s prospects, research from the Resolution Foundation suggests that those who leave education during recessions suffer from lower unemployment rates and depressed pay for years after the event.

“For several years after having left education, employment rates across the cohorts that left education during the [2008] financial crisis were lower than for those who left education after it — with non-graduates experiencing the largest and longest scarring effects,” the organization’s report notes.

Fry added that early anecdotal data showed young adults were drawing on family resources to survive the downturn, often by continuing to live with their parents or by moving back to the family home.

“During the [2008] recession, Millennials dealt with [the crash] by moving in with Mom and Dad,” he said. “We may be seeing Gen Z do the same here. And that’s not a path that’s as open to older Millennials now. They may have families of their own and aren’t able to access those resources. But I don’t think we know the long-term impact of this yet. We just don’t know how long and deep this downturn is going to be.”

Second setback for Millennials

While the immediate crisis has disrupted Generation Z’s education and job prospects, it is the latest in a series of blows for Millennials. The group, which consists of people born between 1981 and 1996, has been shaped by the 2008 global financial crisis and the slow economic recovery that followed.

In 2014, male millennial household heads in the US were found to be earning 10% less than their equivalents in the baby boomer generation in 1978, according to a study by the US Federal Reserve Board. Millennial women were slightly better off than their boomer counterparts, but still earning 3% less than their Generation X equivalents in 1998.

The Pew Research Center defines members of Generation X as those currently aged between 39 and 54, while the baby boomers are aged 55 to 73

“[The Millennial generation] is a particularly aggrieved cohort of young adults,” Reid Cramer, non-resident fellow at the New America Foundation, told CNN. “Already their prime work and family forming years were significantly undermined by coming of age in the great recession.”

“They have lower savings. They have a lower trajectory for [building] long-term wealth. And many are not living in individual households — instead they’re in communal arrangements or still with their parents.”

Millennials also have less of a savings buffer to see them through the coming disruption. Between 2014 and 2016, 52% of British people aged 22-29 had no money set aside in a saving accounts, according to the Office for National Statistics.

In the US, 27% of the age group have no savings, according to a Bank of America report released in January. Despite this, nearly a quarter of those aged 24-41 who did save had more than $100,000 in savings.

Unlike Generation Z, Millennials did not graduate amid what may be the worst global recession since the 1930s. But that’s all likely to be cold comfort for a group that, in the United States, is on track to be the first generation not to accumulate more wealth than their parents.

Searching for solutions

Cramer believes that young people need greater help from government to recover from the financial impact of Covid-19. He argues that public policy should be used to address “the overhang of student debt” hindering millennials in the US.

A similar sentiment is growing in the UK, with regards to housing policy. Home ownership rates among the young have dropped, with Britons in their 30s and 40s three times more likely to be renting today than 20 years ago.

“Millennials are enormously, enormously disadvantaged when it comes to housing,” said Jim O’Neill, chair of the Chatham House think tank and a member of Britain’s House of Lords. “I hope there’s more [government] focus in the future on providing social […] and affordable housing.”

Cramer told CNN the recession following 2008 had affected Millennials in another way — the group is reaching the traditional markers of adulthood at later dates, or not at all.

“In America Millennials have a significantly lower home ownership rate but that only captures some of the challenges,” he said. “Fewer are of them are getting married [and] having children. These were traditional elements of the aspirational American Dream.

“That dream was perhaps best captured by the baby boomers, who remain the richest generation in both the US and UK. This doesn’t look likely to change soon, with Millennials enduring reduced social and economic progress and Generation Z now facing a similar fate.

コメント